OVERVIEW OF THE DEPARTMENT

In accordance with the Pension Reform Act 2014, the Finance and Accounts Department was created in 2020 and is responsible for the preparation of annual budget for the Directorate, is also in charge of receipt, recording, custody and disbursement of the Directorate’s funds and for the maintenance of proper Books of Accounts. The Department also prepares statutory financial reports to supervisory and statutory regulating Ministries and agencies on monthly, quarterly or annual basis. Presently, the Department also has a two Divisions namely; Expenditure Division and Budget/Fiscal Reporting Division with several units under each the division.

FUNCTIONS OF FINANCE AND ACCOUNTS DEPARTMENT

- Ensuring compliance with Financial Regulation and the Accounting Code/Manual by all staff of the Directorate;

- Organizing and supervising the finance and accounting functions in a manner that facilitates:

- adequate financial control, efficiency and smooth operations of the financial management functions;

- the observance of due diligence, economy and cost effectiveness in the Directorate’s administration; and

- ensuring conformity with the Due Process by the Directorate.

- Advising the Chief Accounting Officer on all financial matters as well as the technical provisions of Financial Regulations, other Treasury and Finance Circulars;

- Managing funds in a manner that assures smooth operations of the Directorate;

- Maintaining proper accounting records such as books of accounts, Main and Subsidiary Ledgers, Cashbooks, Vote books etc;

- Ensuring adequate control and management of the Property, Plant and Equipment Register and reconciling the schedule with the General Ledger on monthly basis;

- Ensuring the existence of effective and adequate internal control system to safeguard the assets of the Directorate;

- Ensuring prompt disbursement to pensioners, contractors/suppliers and staff using the Government approved payment mode;

- Ensuring the preparation of annual budget estimates for Pension, Personnel, Overhead and Capital costs; and also prepares budget performance report on quarterly basis.

- Ensuring monthly preparation and submission of Trial Balance and other Financial Statements in line with International Public Sector Accounting Standards (IPSAS) to the OAGF on or before 10th of the following month;

- Ensuring that all staff under the department are exposed to regular training programmes to equip them with relevant skills for the efficient performance of their duties;

- Liaising with the OAGF from time to time when in doubt in the interpretation of the provisions of these Regulations and other Treasury Circulars or when confronted with difficulties in the performance of his duties;

- Ensuring the existence of an effective Audit Query Branch to promptly deal with all queries from Internal Audit Department, OAGF, OAuGF and Public Accounts Committee of National Assembly, etc.

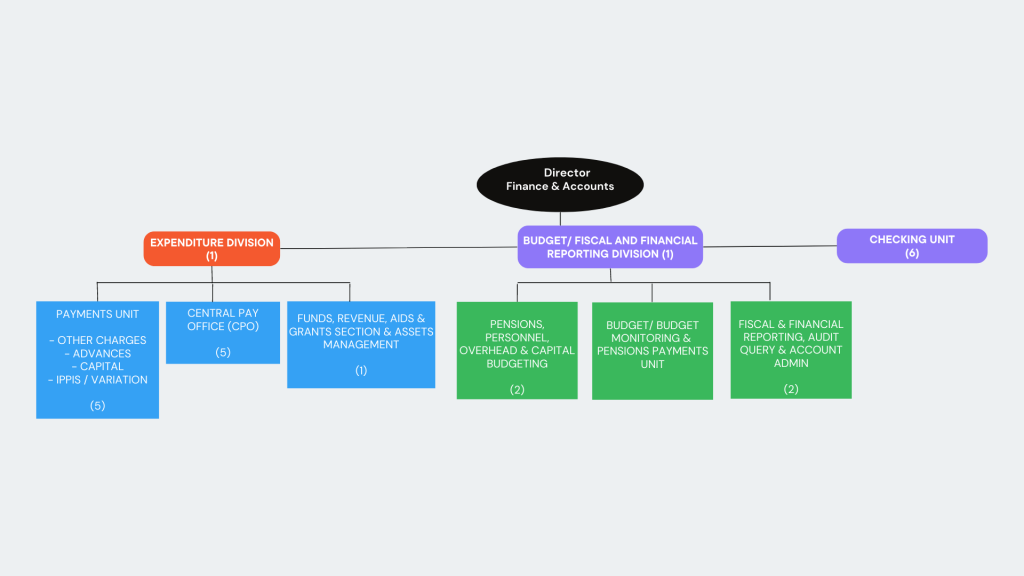

FINANCE AND ACCOUNTS DEPARTMENT ORGANOGRAM

FUNCTIONS OF BUDGET, PENSION AND FISCAL REPORTING DIVISION

- Ensure preparation of Budget estimates for Pension, Personnel, Overhead, and Capital Expenditure for the PTAD; and ensuring proper maintenance of Budget books and records and proper preparation of Budget Performance Reports;

- Providing information for Revenue Budget of the PTAD and identifying Revenue due but not yet paid to the PTAD and accrue for them;

- Ensuring the preparation and presentation of Monthly Trial Balance and General-Purpose Financial Statements on or before 10th of the following month;

- Maintenance of Pension Vote books for Pension payments

- Ensuring Reconciliation of Bank Accounts on a weekly basis

- Ensuring prompt response to Audit Query from NASS, Internal Audit and Federal Audit

- Supporting quarterly, half yearly and annual stock taking/valuation.

- Ensuring Reconciliation of Bank Accounts on a Monthly basis

FUNCTIONS OF EXPENDITURE DIVISION

- Processing approval for overhead and capital expenditures;

- Ensuring the identification and recording of Accounts Payables and record same;

- Organizing the Expenditure functions in a manner that facilitates the keeping of complete and adequate financial/statistical records;

- Ensuring proper disbursement of funds and effective cash management

- Ensuring posting of payments in the relevant cash books on a daily basis;

- Ensuring weekly reconciliation of the Mandate Registers, Cash Books and Vote Books and submit same to the Director of Finance and Accounts;

- Ensuring the reconciliation of the Mandate Registers, Cash Books and Vote Books with the Electronic Payment Platform printout (where applicable) and the Report submitted to the Director of Finance and Accounts on a weekly basis;

- Ensuring the preparation of Cash Book journals and submit same to Financial and Fiscal Reporting Division on or before the 4th of the following month;

- Ensuring that all payments are duly authorized and supported with relevant documents

FUNCTIONS OF CENTRAL PAY OFFICE

- Ensure processing of all audited payment vouchers for Pension, overhead and capital payments on the GIFMIS and Remita Platforms

- Posts paid payment vouchers into relevant Cash Books and daily balancing of all cash books;

- Raise Monthly Journals of each Cashbook and submit same to Financial and Fiscal Reporting Division on or before 4th of the following month;

- Ensure safe custody of Processed payments vouchers and other documents;

- Maintain Mandate Register for each class of Cashbook maintained;

- Reconcile Mandate Register with Cashbook on daily basis;

- To ensure adequate record keeping for NHF deductions from Staff and liaise with Federal Mortgage Bank for update of Staff records.

FUNCTIONS OF PAYMENT UNIT

- Processing Recurrent and Capital Expenditure Payments;

- Ensures proper classification of all Payment Vouchers and Journals in accordance with NCOA;

- Maintain Accounts Payable Register, Accounts Receivable register;

- Maintain Vote Books for Pension Running Cost, Overhead and Capital;

- Processes payment of Advances, Imprest and ensures retirement of outstanding Advances and Imprest accounts;

- Prepares monthly financial monitoring report for Recurrent Expenditure on or before 4th of the following month;

- Maintains Contract Ledger for each Contractor;

- Processes payment of Cash Advances and ensure proper retirement of all outstanding cash advances

FUNCTIONS OF FUNDS, REVENUE AND ASSET MGT. UNIT

- Responsible for issuance of AIE for Recurrent and Capital Expenditure;

- Maintain Master Vote Books for PRC, Overhead and Capital Costs;

- Prepares weekly Expenditure returns and submit same to the ESO every Monday.

- Regular update of Revenue Receivables Register;

- Maintenance of PPE Register and Preparation of PPE Schedule and Notes and reconcile with the General Ledger balances for each class of Asset;

- Supports quarterly, half yearly and Annual Stock taking and report on variances (if any) to the Deputy Director Financial and Fiscal Reporting;

- Supporting quarterly, half yearly and annual stock taking/valuation.

- Ensuring proper Maintenance of Property, Plant and Equipment Register;

FUNCTIONS OF BUDGET/BUDGET MONITORING AND PENSION PAYMENT UNIT

- Collates Personnel, Pension, Recurrent and Capital Expenditure Budget of the Directorate;

- Prepares Medium Term Recurrent and Capital Expenditure Framework (MTEF) and Prepares Medium Term Sector Strategy; (MTSS)

- Liaises with Budget Office of the Federation on Personnel, Pension, Recurrent and Capital Budget of the Directorate;

- Prepares Monthly Personnel, Pension, Recurrent and Capital Expenditure Analysis Report;

- Maintenance of Pension Vote books

- Ensuring weekly reconciliation of Pension Cash Books and Vote Books

FUNCTIONS OF FISCAL REPORTING, AUDIT QUERY AND ACCOUNTS ADMIN UNIT

- Ensuring proper maintenance of General Ledger and the balancing of the General Ledger and extraction of Trial Balance on or before 10th of the following month;

- Ensuring analysis, interpretation and reporting of General-Purpose Financial Statement on or before 15th of the following month;

- Ensuring the preparation of Annual Financial Report of PTAD on or before 21st January the following year and submit to the Office of the Accountant-General of the Federation;

- Ensuring prompt response to Audit Query;

- Maintenance of up-to date Nominal Roll for the Department and liaising with OAGF on matters relating to pool officers

- Organizing training for Finance and Account Staff Periodically posting of Accounts Staff within the various Divisions and Units of the Department

- Making request on behalf of the Department for Stationeries, Consumables and Capital Items for the department

- In charge of welfare matters of the department maintenance of Annual Leave Roster for the Department

FUNCTIONS OF RECONCILIATION UNIT

- The Unit is a useful internal control tool used to detect and prevent fraud.

- It reconciles the balances in our cash books with the balances in our bank statements

- It confirms the actual payments posted to beneficiaries in the voucher and cashbook correspond with the payments posted in our bank statements.

- The process ensures that the actual amount of money spent and earned matches the amount shown leaving and entering the account at the end of a period

FUNCTIONS OF CHECKING UNIT

- The Unit is the first line of audit for all payment vouchers and record before forwarding them to Internal Audit Unit

- Carryout prepayment checks on all vouchers before passing same to Internal Audit

- Ensure Compliance with all the provisions of financial regulations and other extant rules in making payment from government fund.

- Ensure compliance with laid down internal control system to safeguard against loss of government stores and Funds

- Check Statutory returns prepared for submission to OAGF before forwarding to Internal Audit

- Recovery of Funds trapped in dead Pensioners Accounts